Lifetime Deals Are Better...

... for more companies than you'd think. Here's our take, from a business owner's perspective: the pros of why we're switching to lifetime deals (for now, at least) over subscriptions. (Related: We think people are getting tired of subscriptions)

🚀 Boosts/Acceleration 🚀

Product development gets accelerated (the same way a VC-funded company does).

One could say we’re accelerating towards the moment where we could have a more-established product.

You need 12-18 months regardless until the product is beginning to become stable.

Product development gets accelerated (the same way a VC-funded company does).

One could say we’re accelerating towards the moment where we could have a more-established product.

You need 12-18 months regardless until the product is beginning to become stable.

🚀 Boosts/Acceleration 🚀

(If the company presents any kinds of possibility for virality)

Virality needs escape velocity. There can't be any virality if you have 100 users. (Unless the viral coefficient is really high). LTDs accelerate that initial user base.

(If the company presents any kinds of possibility for virality)

Virality needs escape velocity. There can't be any virality if you have 100 users. (Unless the viral coefficient is really high). LTDs accelerate that initial user base.

🚀 Boosts/Acceleration 🚀

Virality needs a critical mass of users. LTD accelerate that. If we trade upfront the LTD deal (which is a risk only if we don’t calculate LTV properly and carefully) for that critical mass, you accelerate. A lot.

Buying time is critical with viral products.

Virality needs a critical mass of users. LTD accelerate that. If we trade upfront the LTD deal (which is a risk only if we don’t calculate LTV properly and carefully) for that critical mass, you accelerate. A lot.

Buying time is critical with viral products.

🚀 Boosts/Acceleration 🚀

Market penetration: For you to be a proper solution, even if you trade LTV, you penetrate the market faster with LTDs

Market penetration: For you to be a proper solution, even if you trade LTV, you penetrate the market faster with LTDs

🚀 Boosts/Acceleration 🚀

Boost in reviews + exposure on the internet: the influx of people establishes you as a solution on the market faster.

Boost in reviews + exposure on the internet: the influx of people establishes you as a solution on the market faster.

🚀 Boosts/Acceleration 🚀

If you have a referral/affiliate program, that gets accelerated too.

If you have a referral/affiliate program, that gets accelerated too.

🚀 Boosts/Acceleration 🚀

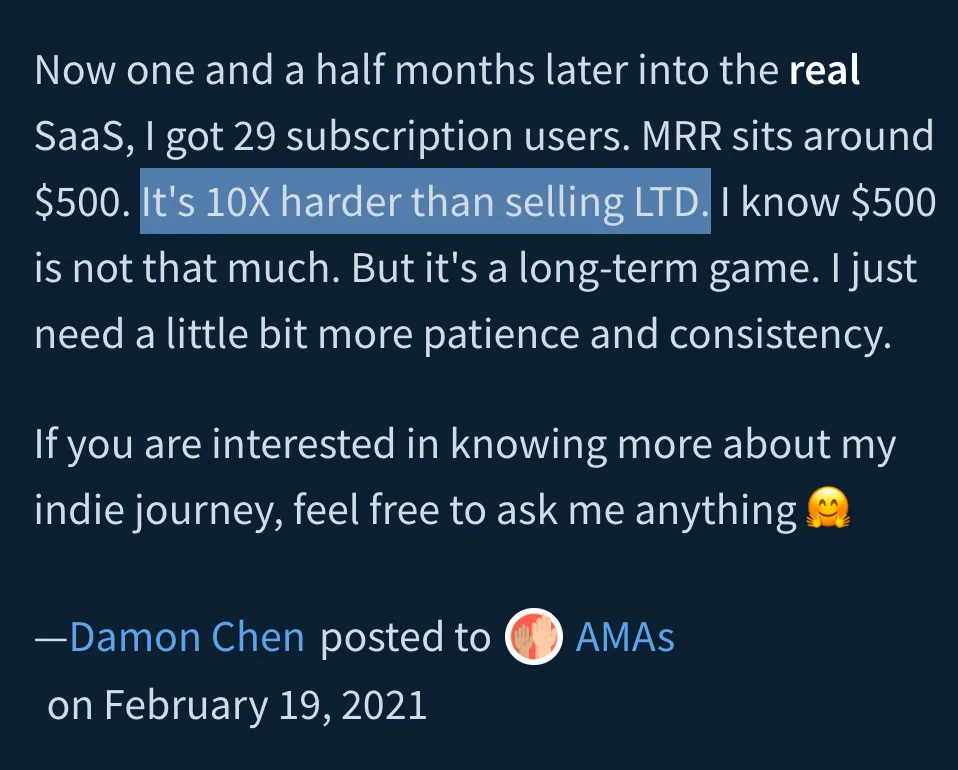

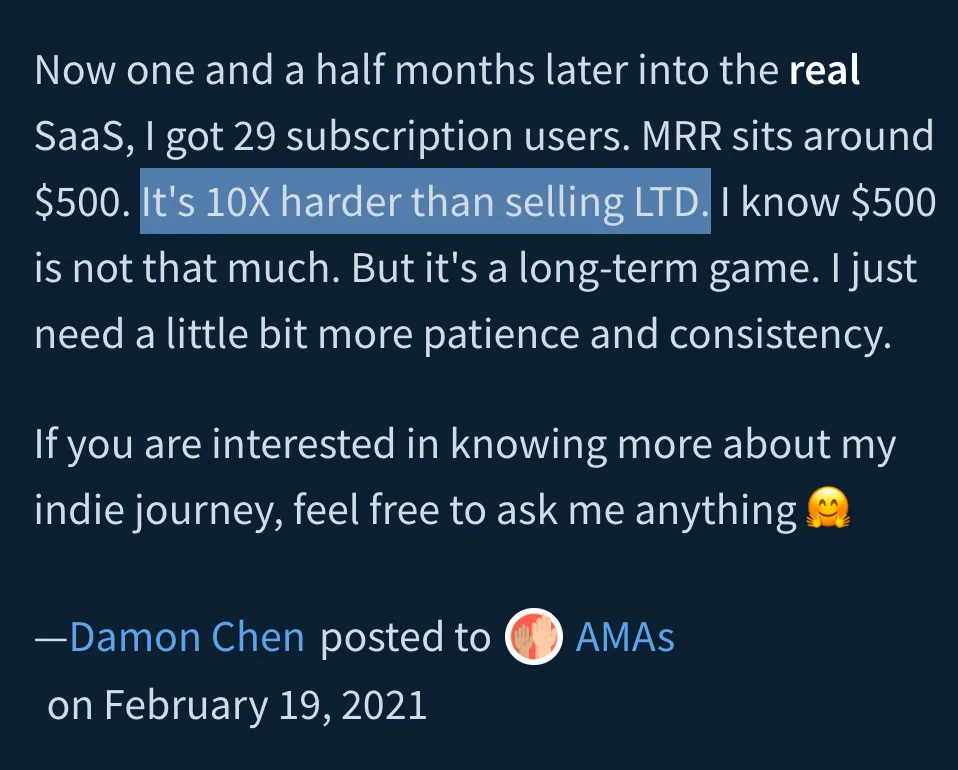

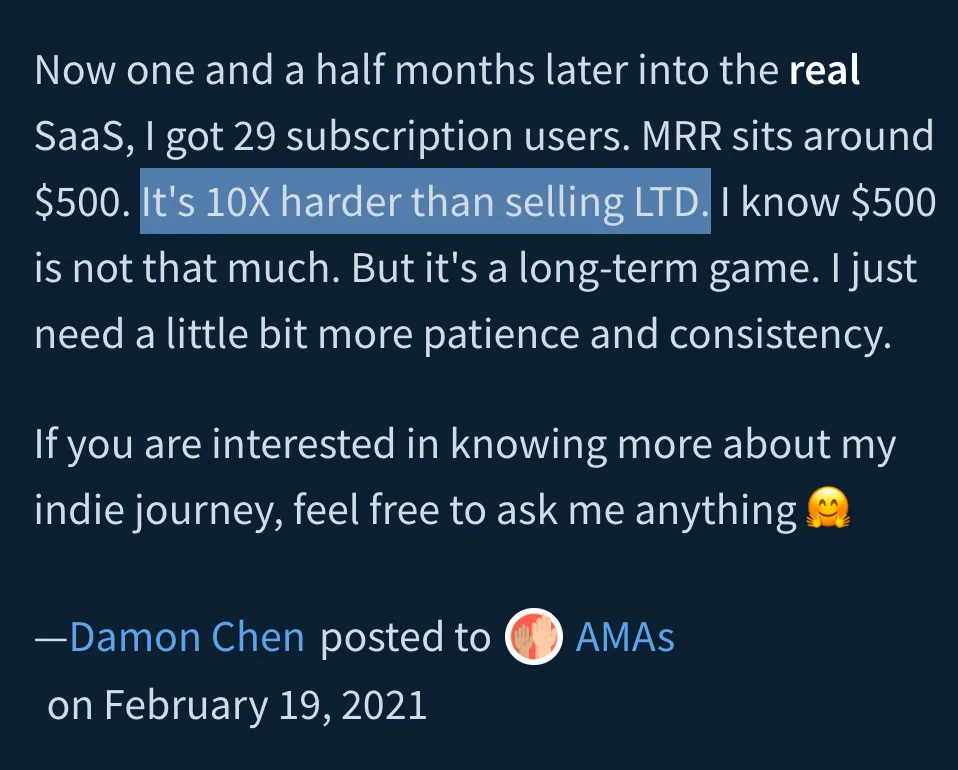

Take for instance a very-good-case-scenario for a SaaS product: 3 months for development, 3.5 months to $1k MRR, 2 months to $2k MRR. So in 5-6 months, you probably make $3,000 to $6,000. You can blow past that with 5-10 LTD sales.

Yes, MRR leads to more value long-term. But if and only if (and that's a big if) the company survives and is thriving in a few years.

Take for instance a very-good-case-scenario for a SaaS product: 3 months for development, 3.5 months to $1k MRR, 2 months to $2k MRR. So in 5-6 months, you probably make $3,000 to $6,000. You can blow past that with 5-10 LTD sales.

Yes, MRR leads to more value long-term. But if and only if (and that's a big if) the company survives and is thriving in a few years.

🚀 Boosts/Acceleration 🚀

In other words: SaaS, even when successful, is slow to take off. LTDs are a trade-off to leave some LTV on the table, in exchange for speed.

In other words: SaaS, even when successful, is slow to take off. LTDs are a trade-off to leave some LTV on the table, in exchange for speed.

🚀 Boosts/Acceleration 🚀

Product: It’s as if we raised money and accelerated the development of the product, since you have the resources to pour into the development.

Product: It’s as if we raised money and accelerated the development of the product, since you have the resources to pour into the development.

🚀 Boosts/Acceleration 🚀

One could say we’re accelerating towards the moment where we could have a more-established product. You anyway need 12-18 months until the product is about to get stable. That could be accelerated.

One could say we’re accelerating towards the moment where we could have a more-established product. You anyway need 12-18 months until the product is about to get stable. That could be accelerated.

Unit economics: most operating expenses are getting cheaper and cheaper — servers, stroage, etc. That is an advantage that keeps on growing.

🏄 Riding the ltd wave 🏄

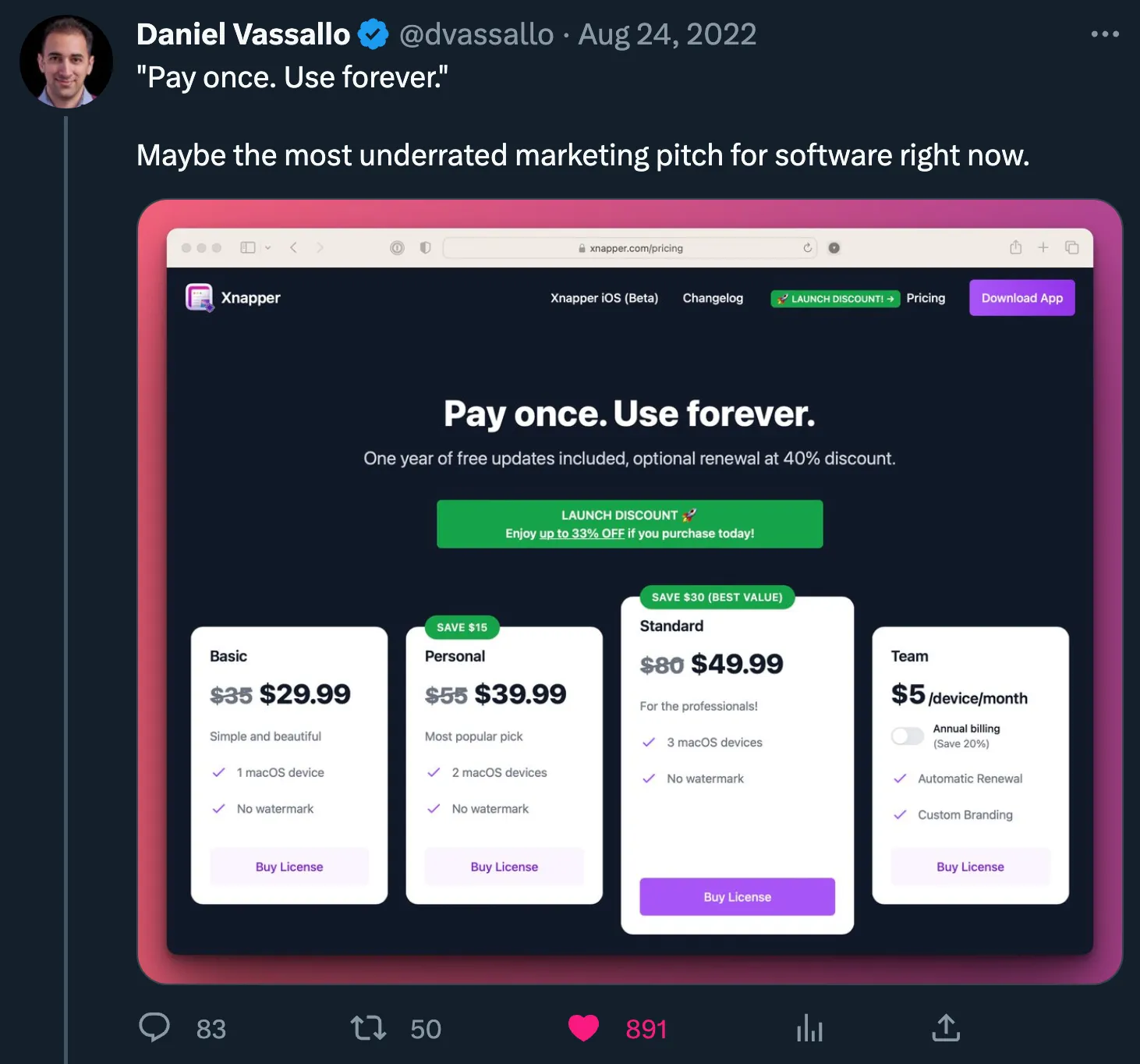

These days, buying an LTD is the under-done move. You can ride that wave. The same way subscriptions were preferred by the market/buyers sentiment a few years ago.

These days, buying an LTD is the under-done move. You can ride that wave. The same way subscriptions were preferred by the market/buyers sentiment a few years ago.

See more

🏄 Riding the ltd wave 🏄

With so many LTD platforms out there hungry for more proper products, it's easier - you're riding a wave.

With so many LTD platforms out there hungry for more proper products, it's easier - you're riding a wave.

🏄 Riding the ltd wave 🏄

LTDs can be an edge over the other products from your industry - competition. You innovate on pricing.

For us, in the eSignature industry, I believe this will be an edge.

LTDs can be an edge over the other products from your industry - competition. You innovate on pricing.

For us, in the eSignature industry, I believe this will be an edge.

🏄 Riding the ltd wave 🏄

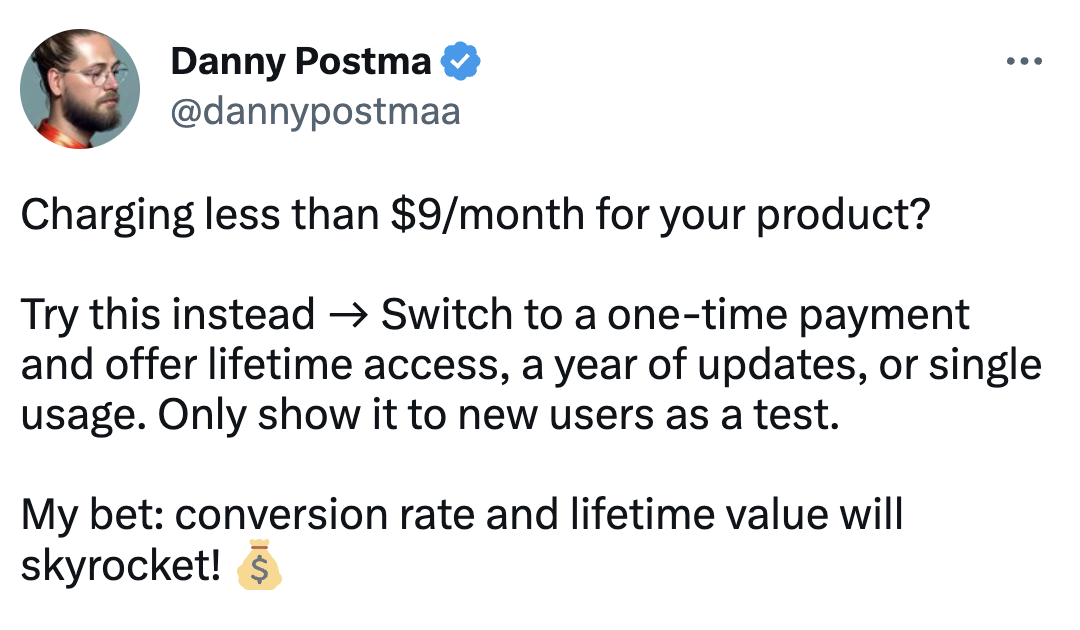

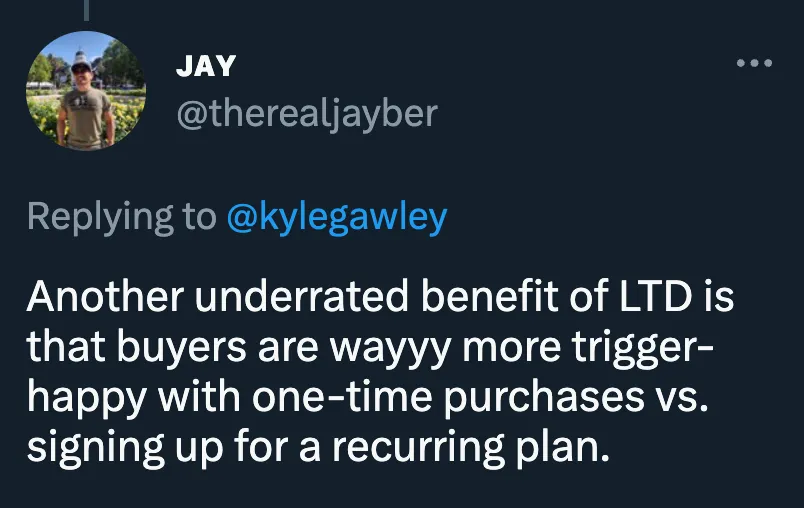

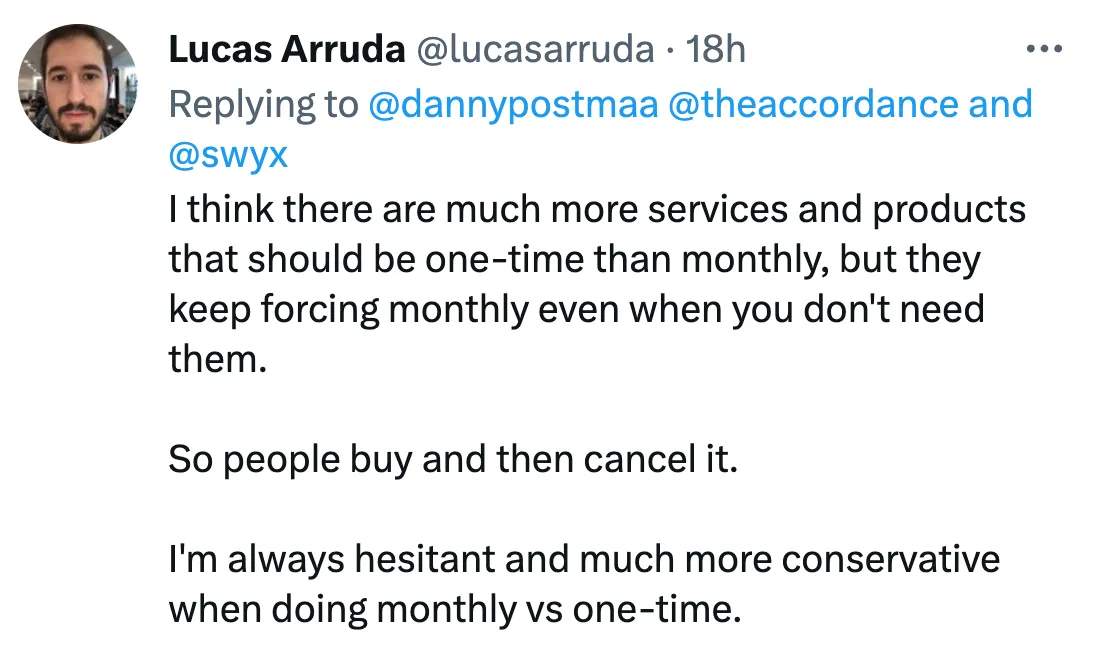

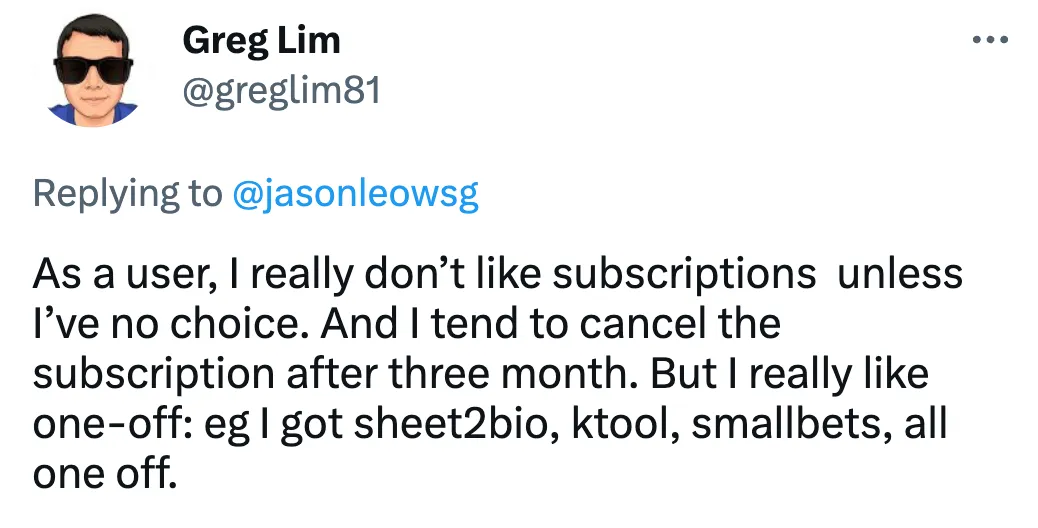

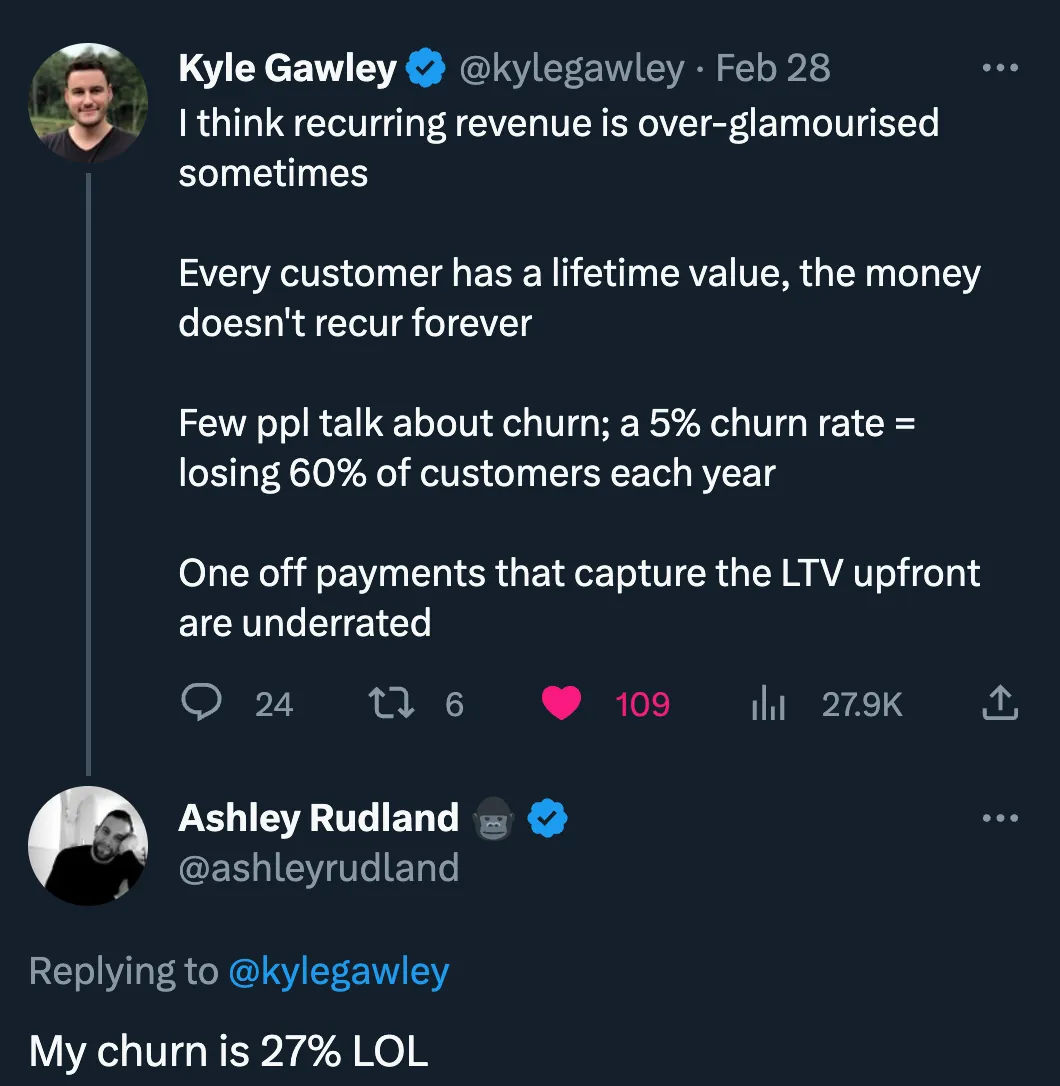

It's just easier to sell LTDs than subscriptions, based on buyers' sentiment

It's just easier to sell LTDs than subscriptions, based on buyers' sentiment

Think about:

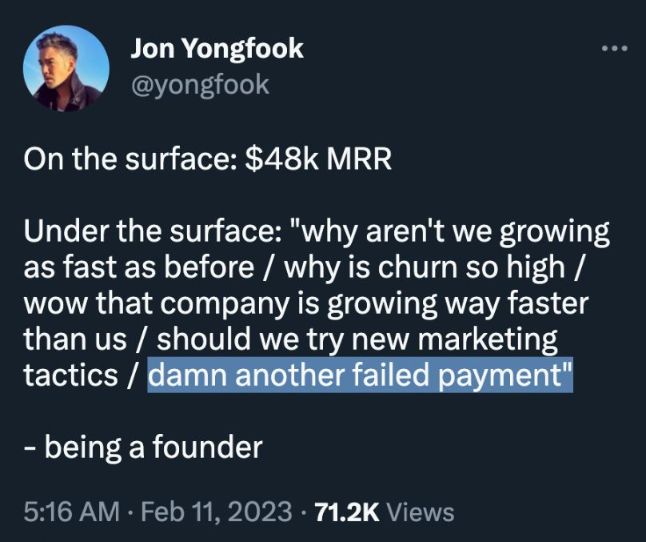

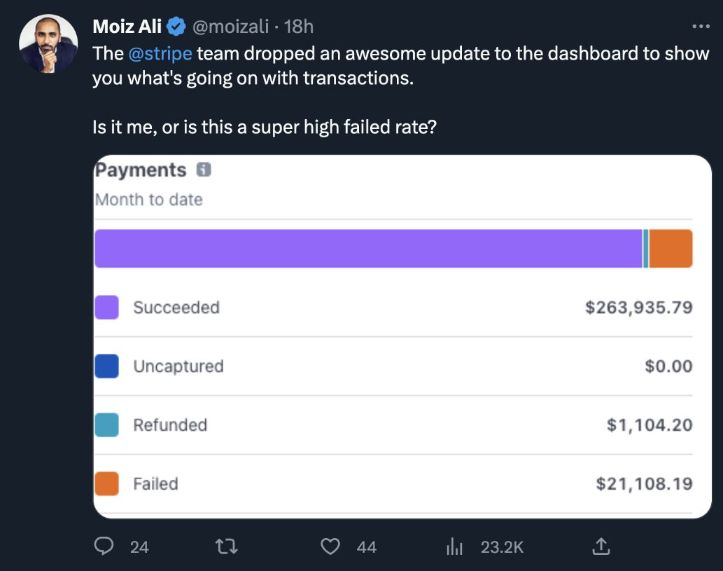

- All the failed payments

- All the payments blocked by bank

- All the Expired cards

- All the situations where Wrong 3DS (SMS verification) code → transaction then gets abandoned

- All the Unrecognized charges by customer

- All money lost to CHARGEBACKS (!)

- And all the Chargeback fees lost...

I'd say that accounts for some 5 to 20% of a company's revenue. It's why there is a need for actual companies that help you recover revenue.

- All the failed payments

- All the payments blocked by bank

- All the Expired cards

- All the situations where Wrong 3DS (SMS verification) code → transaction then gets abandoned

- All the Unrecognized charges by customer

- All money lost to CHARGEBACKS (!)

- And all the Chargeback fees lost...

I'd say that accounts for some 5 to 20% of a company's revenue. It's why there is a need for actual companies that help you recover revenue.

Yearly payments deserve a discount, correct? 16.6% is the standard (2 months free on yearly), but sometimes even 25%.

Why? Mitigation of risk of the above PLUS the fact that you get the money TODAY, which allows you to fuel growth.

Doesn’t, then, paying 2/3/4/5 years of the product, in advance, deserve a discount as well?

Why? Mitigation of risk of the above PLUS the fact that you get the money TODAY, which allows you to fuel growth.

Doesn’t, then, paying 2/3/4/5 years of the product, in advance, deserve a discount as well?

16.6% discounts mean:

- 16.6% for 1yr

- 19.3% for 2 yrs

- 22.5% for 3 yrs

- 26.32% for 4 yrs

- 30.68% for 5 yrs

So 69.32% of the total value price. Factor in the failed payments + others (the card from 2 positions ago) and maybe a 50% discount of the LTV, delivered today, is worth it for a certain number of users.

- 16.6% for 1yr

- 19.3% for 2 yrs

- 22.5% for 3 yrs

- 26.32% for 4 yrs

- 30.68% for 5 yrs

So 69.32% of the total value price. Factor in the failed payments + others (the card from 2 positions ago) and maybe a 50% discount of the LTV, delivered today, is worth it for a certain number of users.

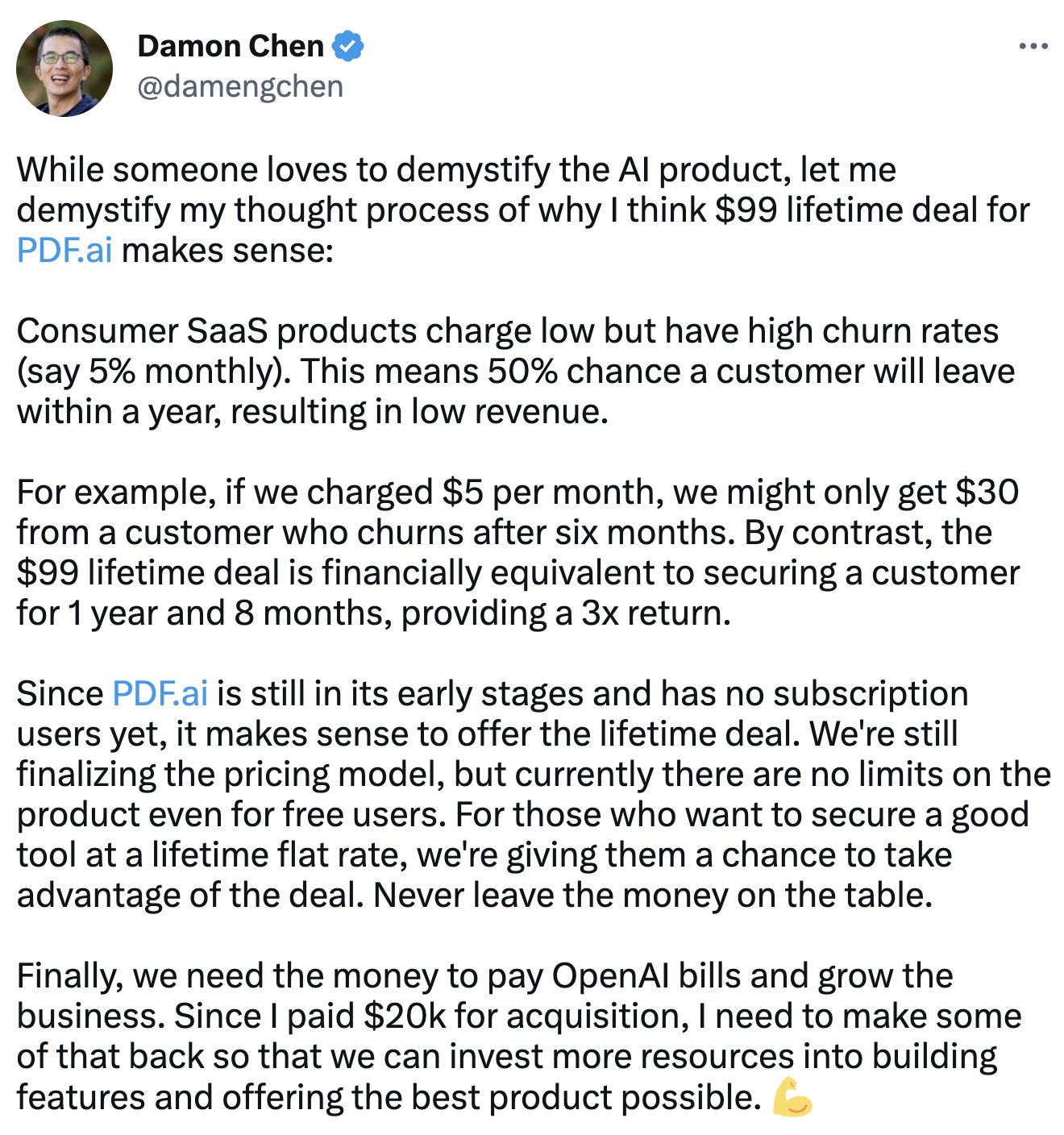

Ultimately, during the lifespan of a company:

Profit = (LTV - CAC - COGS) * Number of customers

Sure, some companies have a variable COGS, e.g. AI Companies. But more products than you'd think are not in that situation.

Profit = (LTV - CAC - COGS) * Number of customers

Sure, some companies have a variable COGS, e.g. AI Companies. But more products than you'd think are not in that situation.

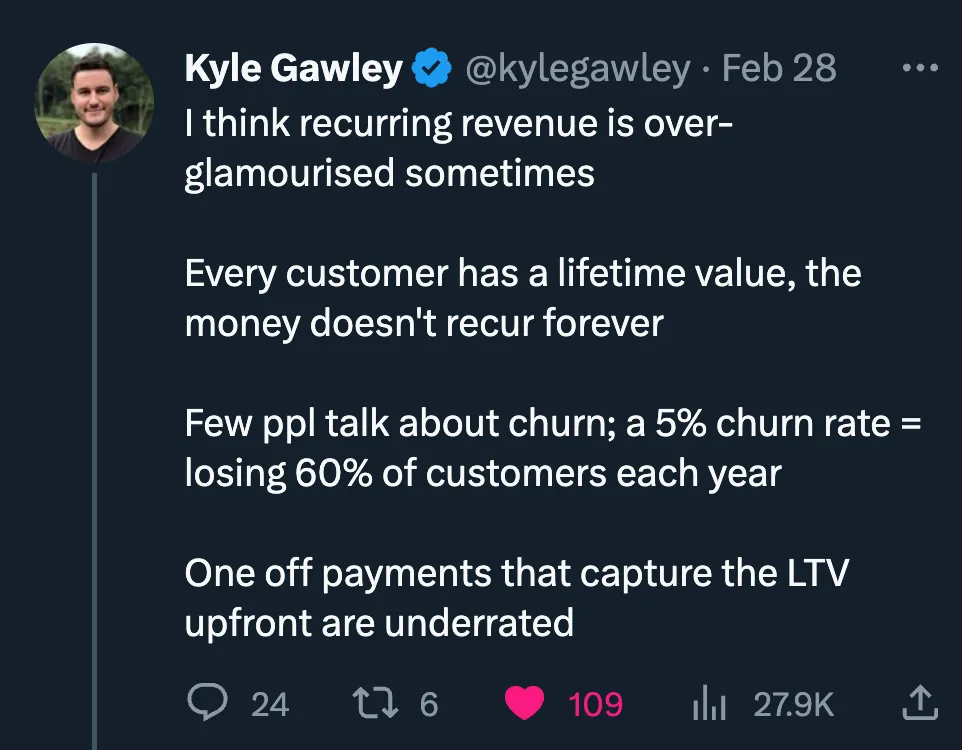

Churn is a bitch for the initial phase of a SaaS. Especially one that sells in an industry where there are so many alternatives (such as SignHouse in the eSig industry)

Why not raise money → fix that → kick into SaaS once we have a proper product?

Why not raise money → fix that → kick into SaaS once we have a proper product?

Better clarity of the company.

With traditional SaaS, you start on MRR, you need to bite the investments costs initially for 6-24 months.

Then you optimize, but only after you find out that the business is established - that there is, in fact, a business. So many have had to learn the hard way that there isn't a business to be built within their idea.

With traditional SaaS, you start on MRR, you need to bite the investments costs initially for 6-24 months.

Then you optimize, but only after you find out that the business is established - that there is, in fact, a business. So many have had to learn the hard way that there isn't a business to be built within their idea.

How can you optimize for lifetime costs (opex) and unit economics…? Without knowing beforehand? With LTDs, you buy yourself a cushion and you:

• Either get it right from the get-go - harder without prior intel

• Risk making a loss on LTD users, but that loss comes in later. However, you buy yourself time to adapt, given it probably takes a couple of years until those users, on the LTD, become a big bill for you to handle.

If done right, the new business you'll make, with this clarity, will pay for those that supported your "research"

• Either get it right from the get-go - harder without prior intel

• Risk making a loss on LTD users, but that loss comes in later. However, you buy yourself time to adapt, given it probably takes a couple of years until those users, on the LTD, become a big bill for you to handle.

If done right, the new business you'll make, with this clarity, will pay for those that supported your "research"

🤔 Who cares? 🤔

Who cares if you don't have NDR or other bullshit metrics that you were told are great to have, if you do not sell to investors and/or public markets? Those, just like MRR, are all just virtual values - in your head. They don't matter ultimately unless you think they matter

"Oh but by year 4 or 5, I will reap the benefits of NDR or MRR, and you will hate your life servicing LTD customers!"

Who knows if you'll be in business in 4 or 5 years?

Who cares if you don't have NDR or other bullshit metrics that you were told are great to have, if you do not sell to investors and/or public markets? Those, just like MRR, are all just virtual values - in your head. They don't matter ultimately unless you think they matter

"Oh but by year 4 or 5, I will reap the benefits of NDR or MRR, and you will hate your life servicing LTD customers!"

Who knows if you'll be in business in 4 or 5 years?

🤔 Who cares? 🤔

LTDs, if calculated properly, are one fractional exit at a time.

Who cares if you sell, unless it's a stupidly high number?

• If you sell, what are you going to do next? Still a company, probably

• Was the money enough?

• How much did you pay in taxes?

In most cases you’re better off continuing to grind it up (unless you get a stupid-high offer)

LTDs, if calculated properly, are one fractional exit at a time.

Who cares if you sell, unless it's a stupidly high number?

• If you sell, what are you going to do next? Still a company, probably

• Was the money enough?

• How much did you pay in taxes?

In most cases you’re better off continuing to grind it up (unless you get a stupid-high offer)

🤔 Who cares? 🤔

Let's talk acquisitions.

Baremetrics sold for 2.65x ARR.

In an exit, you get:

• 1.3x to 4x PROFIT, depending on whether the company is growing.

• Or 2.5x to 5x REVENUE

With LTDs you probably get those 2-3 years upfront. Forget all the virtual metrics you extrapolate: remember the extra 10-20% you get because of handling the following differently over the 2-4 years: churn, failed payments, etc.

Let's talk acquisitions.

Baremetrics sold for 2.65x ARR.

In an exit, you get:

• 1.3x to 4x PROFIT, depending on whether the company is growing.

• Or 2.5x to 5x REVENUE

With LTDs you probably get those 2-3 years upfront. Forget all the virtual metrics you extrapolate: remember the extra 10-20% you get because of handling the following differently over the 2-4 years: churn, failed payments, etc.

🤔 Who cares? 🤔

Cash-flow-business based (e.g. Pieter Levels) software entrepreneurs are mentioning this too: why sell a proper company (i.e. lean, properly set up) when you can just wait those 2-3 years and keep the revenue for long-term.

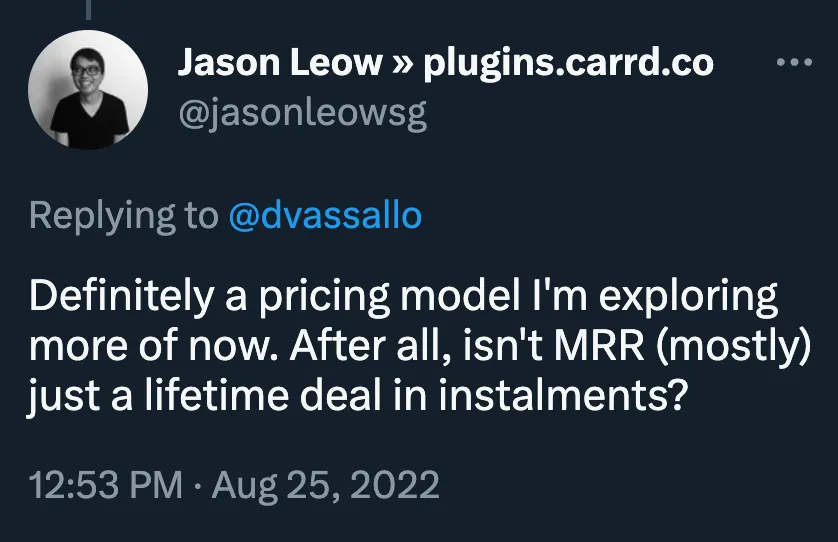

Yes, LTD money is there just in the beginning, then they become a liability. But it's probably fairer to switch into MRR/subscription once you have a proper product that justifies a subscription.

Cash-flow-business based (e.g. Pieter Levels) software entrepreneurs are mentioning this too: why sell a proper company (i.e. lean, properly set up) when you can just wait those 2-3 years and keep the revenue for long-term.

Yes, LTD money is there just in the beginning, then they become a liability. But it's probably fairer to switch into MRR/subscription once you have a proper product that justifies a subscription.

🤔 Who cares? 🤔

If the math of the LTD doesn't add up perfectly with your actual LTV, but ultimately you're doing fine: a profitable company that has happy customers and is not going bankrupt.

"Yes but you're leaving money on the table!"

Who cares if you’re going to make $17M instead of $28M all-time? That's enough of a platform to create a 2nd product - subscription or not.

SaaS companies have an expiry date too. We've just been spoiled by continuously growing markets and believed the lie that they're going to grow infinitely.

If the math of the LTD doesn't add up perfectly with your actual LTV, but ultimately you're doing fine: a profitable company that has happy customers and is not going bankrupt.

"Yes but you're leaving money on the table!"

Who cares if you’re going to make $17M instead of $28M all-time? That's enough of a platform to create a 2nd product - subscription or not.

SaaS companies have an expiry date too. We've just been spoiled by continuously growing markets and believed the lie that they're going to grow infinitely.

SaaS companies die as well, due to not adapting. Every company has an expiration date. It's just too early to see that being accepted more widely.

Just like film developing shops (photo processing) died not because they weren't run properly, but because markets changed - the same thing can happen in SaaS.

Just like film developing shops (photo processing) died not because they weren't run properly, but because markets changed - the same thing can happen in SaaS.

You pay taxes to your government, given that you get the profits all at once. This way you won't end up being one of the many tech companies that avoid paying their tax.

71% of the revenue of public SaaS companies is from enterprise.

That's a whole discussion to be had.

That's a whole discussion to be had.

You could say you're raising that money to be able to actually compete, at one point, in Enterprise — if you wish to swing for the fences.

Lower billing complexity means:

• Less customer support to be done

• Avoid having to build: manage subscription, upgrade/cancel

• Customer gets angry when they upgrade/downgrade because pro-ration is calculated… or that it ISN’T calculated:

• "Why am I being charged $0.481? Wtf? I need to speak to an agent right now!!"

• “I subscribed to $8/mo yesterday and today upgraded to $20/mo. Why didn’t I pay just $12?????”

• Send billing emails to this email address, not to that one

• Tax IDs, validation, VAT

etc.

• Less customer support to be done

• Avoid having to build: manage subscription, upgrade/cancel

• Customer gets angry when they upgrade/downgrade because pro-ration is calculated… or that it ISN’T calculated:

• "Why am I being charged $0.481? Wtf? I need to speak to an agent right now!!"

• “I subscribed to $8/mo yesterday and today upgraded to $20/mo. Why didn’t I pay just $12?????”

• Send billing emails to this email address, not to that one

• Tax IDs, validation, VAT

etc.

Acquisitions are overrated (click me)

Take the example of Basecamp, the holy grail of bootstrapped SaaS success. Tens of millions in profits per year today (if not more), hundreds of millions of revenue per year.

Not everyone is Basecamp, but let's take the best case scenario.

What did they do, a few years after starting and showing promising results? They sold a part of the company, to Jeff Bezos, in exchange for a couple of million.

Not everyone is Basecamp, but let's take the best case scenario.

What did they do, a few years after starting and showing promising results? They sold a part of the company, to Jeff Bezos, in exchange for a couple of million.

Quick maths: 130k paying users in 2016. Let’s say 10-20k are LTD users, rest are paid users.

Since people paid $99/mo for a long time for unlimited users, let's assume a $499 price point for an LTD.

LTD Revenue: $5M to $10M USD

The other 100k-110k users: $99/mo. But let's just say $90/mo.

SaaS revenue: $118.8M to $130M

Since people paid $99/mo for a long time for unlimited users, let's assume a $499 price point for an LTD.

LTD Revenue: $5M to $10M USD

The other 100k-110k users: $99/mo. But let's just say $90/mo.

SaaS revenue: $118.8M to $130M

(I don't suspect all 130k paying users are on the $99 plan, as they've had different plans that they've grandfathered over the years. But then again that number of 130k is from 2016, way before the pandemic. Oh well)

My conclusion is: what do you do even when you hit a home run?

You still sell, to de-risk the operation. And that's "money left on the table". But they don't regret doing that.

What I see: even when you win clearly, you still end up in this kind of situation.

My conclusion is: what do you do even when you hit a home run?

You still sell, to de-risk the operation. And that's "money left on the table". But they don't regret doing that.

What I see: even when you win clearly, you still end up in this kind of situation.

Unless you’ve got low churn (and note: you have to have done a churn reduction exercise in the past, otherwise you don't know if you're actually able to make it), you will fail to factor in the churn of your SaaS product into the development of the company.

(Don't say "that won't be me". You actually don't know what a company's churn will roughly be, unless you've got info/past experience for a company in the industry)

(Don't say "that won't be me". You actually don't know what a company's churn will roughly be, unless you've got info/past experience for a company in the industry)

Closing thoughts: I most will change my mind at one point about this. That said, I still stand behind everything I've listed above — for:

1. Most people without a platform of wealth

2. Companies that are eligible to be sold as an LTD

Selling LTDs is a way better option than going down the VC route or 100% bootstrapped, all things considered.

1. Most people without a platform of wealth

2. Companies that are eligible to be sold as an LTD

Selling LTDs is a way better option than going down the VC route or 100% bootstrapped, all things considered.

People agree